Industrial Rebound - Warehouses and Distribution Centers Fueling Growth in 2021

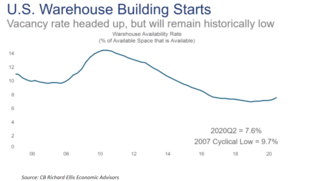

The warehouse market sector is the only commercial/industrial sector to see net gain in 2020, with projections of continued growth (+2% in 2020 and up to +8% projected into 2021). Although vacancy rates are elevated due to COVID-19 impacts, they remain at historic lows. Warehouse building starts are predicted to reach 8% in 2021 according to Richard Branch’s COVID-19 Construction Starts Forecast Update 2020 Q3.

The evolution of modern warehouse and distribution centers started over a decade ago with the expansion of online retail and e-commerce adoption. Impacts according to CBRE Industrial and Logistic Market research include the following:

-

By 2018, the net demand for warehouse space remained positive for over 31 consecutive quarters – a record streak at the time.

- The physical structure of warehouses morphed to accommodate e-commerce specifications including:

-

In the past 17 years, the average size of a newly built warehouse doubled to 185,000 sq. Ft. Presently, AHBL routinely designs warehouses that are 400,000 – 1,000,000 sq. ft!

-

US warehouses have gotten taller too, newly constructed warehouses now clear heights of 32.3 feet on average up from 28.6 feet in the early 2000s. This too has expanded upward with 2020 seeing 36-40 feet of clear space to accommodate greater volume and automation necessary in these modern warehouses.

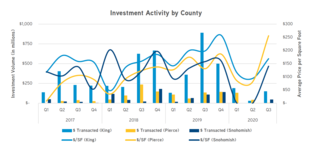

- Demand for warehousing has driven the average parcel price to more than double in the past eight years.

- The physical structure of warehouses morphed to accommodate e-commerce specifications including:

According to Colliers International Q3 2020 Industrial Report:

- E-commerce and underlying market fundamentals remain healthy,

- Vacancy trended upward in the Puget Sound by 60 basis points from Q2 2020 much due to new supply delivered to the market and moveouts in marketing north of Pierce and Thurston counties

- 87% of the 6.2M SF of space currently under construction is in Pierce in Thurston counties.

- Warehouse space accounts for 91.5% (5.6M SF) of the current development pipeline as developers seek to satisfy the e-commerce demand.

Throughout the history of AHBL, we have completed projects of almost every kind. As the market fluctuates, we often find ourselves changing with it and specializing in more and more project types. Over the years, our industrial work portfolio has typified this response to an ever-changing economy.

Throughout the history of AHBL, we have completed projects of almost every kind. As the market fluctuates, we often find ourselves changing with it and specializing in more and more project types. Over the years, our industrial work portfolio has typified this response to an ever-changing economy.

Before COVID-19, the global economy was trending heavily toward e-commerce. Market reports and economic forecasting indicate that e-commerce and distribution will only continue to grow, especially considering global pandemic and disruption of traditional commercial avenues.